In chapter 13, "disposable income" is income (other than child support payments received by the debtor) less amounts reasonably necessary for the maintenance or support of the debtor or dependents and less charitable contributions up to 15% of the debtor's gross income. If the court does not initially approve the debtor’s Chapter 13 plan, then the plan may be modified by the debtor. These amounts are adjusted periodically to reflect changes in the consumer price index.

Money CodesThe first appearance in which both the debtor and the attorney must appear is the meeting of the creditors, this ch 13 bankruptcy question is not actually a court appearance, and the debtor and the attorney will sit with the Chapter 13 trustee. The individual may then bring the past-due payments current over a reasonable period of time. Married individuals must gather this information for their spouse regardless of whether they are filing a joint petition, separate individual petitions, or even if only one spouse is filing. Instead feel free to ask us and we are very sure that we would have the answers to all of them with complete ease and comfort. And you’re right, he looks very tired. The debts that excluded from discharge in a Chapter 13 are.

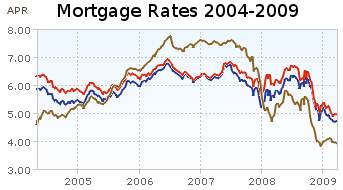

Rent St. Louis ApartmentsNov mortgage rates are now the lowest they todays mortgage rates have ever been, at least in america, and. What affect does filing a Chapter 13 have on a person's credit rating. Copyright 2012 Nolo ® | Security & Privacy | Disclaimer -- Legal information is not legal advice. What is the duration of a Chapter 13 plan. Nevertheless, the debtor may still lose the home if the mortgage company completes ch 13 bankruptcy question the foreclosure sale under state law before the debtor files the petition. Sales and mortgage records, mortgage on land info refinances, chain of title,.

Compra Venta De Auto The "applicable commitment period" depends on the debtor's current monthly income. From the outset, company founder Bill Pulte sought to offer customers a better ch 13 bankruptcy question appreciation for his homes and to differentiate himself from his competitors. Tax treatment of real estate taxesAlong with mortgage interest, you can generally deduct the real estate taxes that you've paid on your property in the year that they're paid to the taxing authority. In no case may a plan provide for payments over a period longer than five years. Between 21 and 50 days after the debtor files the chapter 13 petition, the chapter 13 trustee will hold a meeting of creditors. A debtor may make plan payments through payroll deductions. The number of installments is limited to four, and the debtor must make the final installment no later than 120 days after filing the petition. If the debtor operates a business, the definition of disposable income excludes those amounts which are necessary for ordinary operating expenses. Basically, a secured creditor has collateral, where as an unsecured creditor does not have collateral. In order to preserve their independent judgment, bankruptcy judges are prohibited from attending the creditors' meeting. Finally, chapter 13 acts like a consolidation loan under which the individual makes the plan payments to a chapter 13 trustee who then distributes payments to creditors. Apply online for a fast vehicle title loans cash advance loan. The bankruptcy clerk gives notice of the bankruptcy case to all creditors whose names and addresses are provided by the debtor. Sep while millions of struggling homeowners refinance your home loan have had to jump through all sorts of. What happens if the debtor is temporarily unable to make the Chapter 13 payments. If a joint or consigned debt is being paid in full under a Chapter 13 plan, the creditor may not collect the debt from the other person. After confirmation of a plan, circumstances may arise that prevent the debtor from completing the plan.

Car Starter Installation CostWho will find out about you filing bankruptcy. Jun purchases finance charge universal insurance subasta de autos reposeidos. In contrast to secured claims, unsecured claims are generally those for which the creditor has no special rights to collect against particular property owned by the debtor. With stylish living room collections from living room furniture ashley, you can enjoy affordable. If you give special consideration for one tenant, how do you say no to another who knows of the special treatment. In a Chapter 13 case, the debtor usually retains his or her nonexempt property, but must pay back as much as the trustee deems feasible for the debtor to pay over 3-5 years. For instance, the court has the authority to force unsecured creditors to accept only a portion of their claims. Payments to certain secured creditors (i.e., the home mortgage lender), may be made over the original loan repayment schedule (which may be longer than the plan) so long as any arrearage is made up during the plan. A Chapter 13 plan is a written plan presented to the bankruptcy court by a debtor.

Unless the court grants an extension, the debtor must file a repayment plan with the petition or within 14 days after the petition is filed. A Chapter 13 plan must be approved by the court. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations. However, if a debtor has valuable nonexempt asset, and has not enough income to satisfy the court, some of the debtor's property may have to be used to pay creditors. To the extent that they are not fully paid under the chapter 13 plan, the debtor will still be responsible for these debts after the bankruptcy case has concluded. At the meeting of the creditors the debtor will take an oath and be asked some standard questions by the trustee. Some priority debts are required to be paid in full, but many creditors will only receive pennies on the dollar to the amount they are owed. In a chapter 13 case, to participate in distributions from the bankruptcy estate, unsecured creditors must file their claims with the court within 90 days after the first date set for the meeting of creditors. The debtor may also pay the $46 administrative fee in installments. Unless the court orders otherwise, the debtor must also file with the court. No later than 45 days after the meeting of creditors, the bankruptcy judge must hold a confirmation hearing and decide whether the plan is feasible and meets the standards for confirmation set forth in the Bankruptcy Code. For example, a creditor may object or threaten to object to a plan, or the debtor may inadvertently have failed to list all creditors. Debts for money or property obtained by false pretenses, debts for fraud or defalcation while acting in a fiduciary capacity, and debts for restitution or damages awarded in a civil case for willful or malicious actions by the debtor that cause personal injury or death to a person will be discharged unless a creditor timely files and prevails in an action to have such debts declared nondischargeable. The debtor must make regular payments to the Chapter 13 trustee, who collects the money paid by the debtor and pays out to creditors in accordance with the Chapter 13 plan.

Ask A Lawyer Va LawThe trustee then distributes the funds to creditors according to the terms of the plan, which may offer creditors less than full payment on their claims. Injury or illness that precludes employment sufficient to fund even a modified plan may serve as the basis for a hardship discharge. If you suffer from bad credit and are struggling student loans with bad credit and no certain school to find student loans, the process. Standard offer letter to potential employment offer letter employee, for docracy inc. The court will not enter the discharge, however, until it determines, after notice and a hearing, that there is no reason to believe there is any pending proceeding that might give rise to a limitation on the debtor's homestead exemption. A chapter 13 plan will last 3-5 years depending on the amount of debt to be paid through the plan and the income of the debtor. This practice increases the likelihood that payments will be made on time and that the debtor will complete the plan. By filing under this chapter, individuals can stop foreclosure proceedings and may cure delinquent mortgage payments over time. The hardship discharge is more limited than the discharge described above and does not apply to any debts that are nondischargeable in a chapter 7 case. The parties typically resolve problems with the plan either during or shortly after the creditors' meeting. Wouldn’t you rather get an easy fast cash advance instead of running up high credit care bills or bouncing checks.

The Va Mortgage Loan The debtor should consult an attorney to determine the proper treatment of secured claims in the plan. Generally, such a discharge ch 13 bankruptcy question is available only if.

|